See also Designing Pay Levels, Pay Mix and Pay Structure and Pay Employment Benefits

decision for externally competitive pay levels and structure.

- employer’s competitive pay policy

- purpose of survey

- construct market line.

- balance competitiveness with internal alignment through pay range, flat rates, bands

survey.

- adjust pay level

- pay mix: stock, benefits

- pay structure: job evaluation results.

- estimate competitors’ labour costs (competitive intelligence)

design

Which job to include?

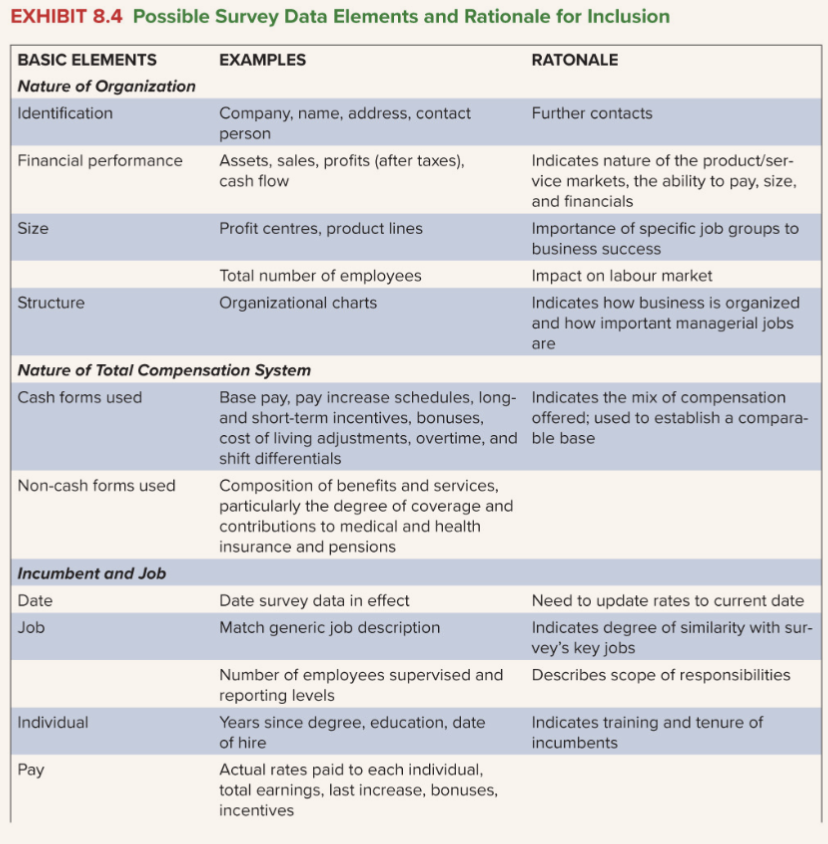

- benchmark job approach, low-high approach, conversion/survey level What information to collect?

- organisation data, total compensation data, information about incumbent

interpretation

Verify anomalies, accuracy of match, validation to other trends.

select relevant market competitors

- Relevant labor markets

- Fuzzy markets: new orgs/orgs with unique jobs fuse diverse factors for relevant markets fuzzy

Question

What factors determine the relevant market for pay surveys? Why is the definition of the relevant market important?

- Industry and Job Function: depending on the job sector and industry size.

- Geographic Location: location-based pay

- Experience and Education Level: pay for experience and education

- Market trends: market trends and changes

importance because:

- Competitiveness: to attract and retain employees.

- Fairness and Equity: enhance satisfaction and reduce turnover.

- Legal compliance: to avoid discrimination.

organization

| Basic Elements | Examples | Rationale |

|---|---|---|

| Identification | Company name, address, contact person | Further contacts |

| Financial performance | Assets, sales, profits (after taxes), cashflow | Indicates nature of the product/service markets, the ability to pay, size and financials |

| Size | Profit centres, product lines | Importance of specific job groups to business success |

| Total number of employees | Impact on labour market | |

| Structure | Organizational charts | Indicates how business is organized and how important managerial jobs are. |

Total compensation

- cash forms used

- non-cash forms used

| Advantages | Disadvantages | |

|---|---|---|

| Base pay | Tells how competitors are valuing the work in similar jobs. | Fails to include performance incentives and other forms, so will not give true picture if competitors offer low base but high incentives. |

| Total cash | Tells how competitors are valuing work; also tells the cash pay for performance opportunity in the job. | Not all employees may receive incentives, so it may overstate the competitors’ pay; plus, it does not include long-term incentives. |

| Total compensation (base + bonus + stock options + benefits) | Tells the total value competitors place on this work. | All employees may not receive all the forms. Don’t set base pay equal to competitors’ total compensation. |

incumbent & jobs

| Basic Elements | Examples | Rationale |

|---|---|---|

| Date | Date survey data in effect | Need to update rates to current date |

| Job | Match generic job description | Indicates degree of similarity with survey’s key jobs |

| Individual | Number of employees supervised and reporting levels | Describes scope of responsibilities |

| Years since degree, education, date of hire | Indicates training and tenure of incumbents | |

| Pay | Actual rates paid to each individual, total earnings, last increase, bonuses, incentives |

hr outcomes.

| Basic Elements | Examples | Rationale |

|---|---|---|

| Productivity | Revenues to employee ratio, revenues to labour costs ratio | Reflect organization performance and efficiency |

| Total labour costs | Number of employees x (average wages and benefits) | Major expense |

| Attraction | Yield ratio, number accepting offer to number of job offers ratio | Reveals recruiting success |

| Retention | Turnover rate; number of high or low performers who leave to number of employees ratio | Reveals outflow of people |

| Employee views | Total pay satisfaction | Reveals what employees think about their pay |

market pay line

links a company’s benchmark jobs on horizontal axis with market rates paid by competitors on the vertical axis.

Internal structure and external market rates

- pay-policy line

- pay ranges

pay-policy line

percent above or below market line intend to “lead”, “lag”, or “match” rate.

Develop grades

single grade will have same pay range

pay range

- midpoints where pay-policy line crosses centre of grade, minimum and maximum

- larger ranges in managerial jobs reflect the greater opportunity for performance variants in the work

- firm uses percentiles as maximum and minimums while other establish them separately.

pay disparity among candidates.

- Internal pressures

- recognize performance pay difference with pay

- expectations pay over time

- External pressures

- difference in quality among individuals

- difference in productivity or value variations

- mix of pay forms

range overlap

Overlap ought to be large enough to induce employees to seek promotions.

Broadbanding

collapse salary grades into a few broad bands, each with a minimum and maximum

- flexibility

- career growth

Employee Benefits

- Flexible hours

- WFH: 45% of employees love their jobs (according to Forbes)

- Vacation time and PTO: No timeout more prone to burnt out

- Pay parental leave

part of compensation package, other than pay for time worked.

Growth in Employee Benefits

- Cost effectiveness of Benefits

- Union

- Employer impetus

- Government Impetus

issues.

-

ensure external competitiveness

-

adequacy of benefits

-

Who should be protected?

-

How much choice should employees have among an array of benefits?

-

How should benefits be financed?

Question

How does external equity differ when pay versus benefits?

- Pay is quantifiable regarding monetary values, whereas benefits are objective in terms of equity.